Why The Buffett Indicator Is Important To You

The Buffett Ratio, often referred to as the Buffett Indicator, is a metric championed by Warren Buffett to gauge the overall valuation of the stock market relative to the economy. It’s calculated by dividing the total market capitalization of all publicly traded stocks in a country (or region) by that country’s Gross Domestic Product (GDP). Essentially, it’s a way to see how much the stock market is worth compared to the economic output it’s built on.

For example, if the total value of all stocks in the U.S. is $50 trillion and the U.S. GDP is $25 trillion, the Buffett Ratio would be 2, or 200%. Buffett has suggested that when this ratio gets too high—say, well above 100%—it’s a signal that stocks might be overvalued and due for a correction. Conversely, a ratio below 100% could indicate undervaluation and a potential buying opportunity.

He’s famously quoted as calling it "probably the best single measure of where valuations stand at any given moment." It’s not a precise timing tool, but more of a big-picture sanity check. Historically, it’s spiked before major market downturns—like the dot-com bubble and the 2008 financial crisis—though it’s not infallible, and critics argue it doesn’t account for things like globalization or changes in interest rates that can skew the picture today compared to decades past. What’s your take on using something like this to judge the market?

How To Compute Buffett’s Magic Formula

To compute the Buffett Ratio (or Buffett Indicator) for you, I need two specific pieces of data: the total market capitalization of all publicly traded stocks in a given country and that country's Gross Domestic Product (GDP). Since you haven’t specified a country or provided the numbers, I’ll walk you through how it’s done and then use the most recent U.S. data I can reasonably estimate as of today, February 23, 2025, to give you an example.

This gives you a percentage that shows how the stock market’s value stacks up against the economy’s output.

Example: United States as of February 2025

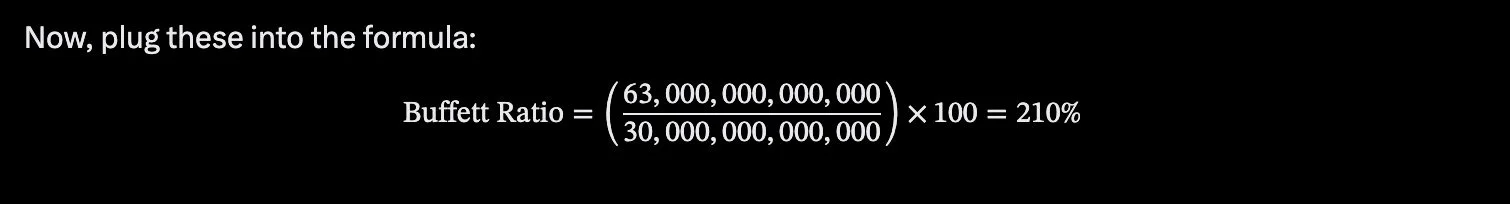

Total Market Capitalization: As of early 2025, the U.S. stock market’s total value has been reported around $62.2 trillion (based on figures like those from Siblis Research for January 1, 2025). The market has been growing steadily this year, so let’s assume a modest increase to about $63 trillion by late February, factoring in recent bullish trends.

GDP: The U.S. nominal GDP for 2024 was around $28-29 trillion, with projections for 2025 suggesting growth to roughly $30 trillion by now, given annual growth rates of about 2-3% in nominal terms.

So, for the U.S., the Buffett Ratio might be around 210% as of today. This aligns with chatter I’ve seen about it hitting record highs recently, suggesting stocks are priced at more than double the economy’s annual output—a level Warren Buffett has historically flagged as “playing with fire” when it nears or exceeds 200%.

A Call to Action: Re-Evaluate Your Investments Now

As we face what could be one of the most significant market corrections in history, it's crucial to evaluate how your assets are invested. The time for complacency has passed. Now is the moment to reassess your portfolio, reduce exposure to high-risk investments, and strengthen your financial position with safer assets.

Consider incorporating asset classes that have historically benefited from market corrections. Embracing these proven strategies can help protect your financial future, ensuring you're not only prepared to weather the storm with the real possibility of growing your assets when the much overdue market correction occurs.

I'm here to help you make these critical decisions. With my expertise and personalized strategies, I can guide you in fortifying your financial future. Don't leave your assets to chance—reach out to me today to schedule a consultation. Together, we'll create a plan tailored to your needs, positioning you for stability and success no matter what the market brings.